Thinking about for 2024 (and beyond): Demographics and destiny

This time of the year is mostly controlled by the prediction industrial complex which, in my most recent life, I used to fully participate in. However this is more of a what-will-2034-Dylan-wish-that-2024-Dylan-was-thinking-about post rather than any kind of predictions list1.

In between my somewhat Gallifreyan life of building companies and investing, I study ancient history, specifically the mesolithic and neolithic periods (roughly 10,000bc-1000bc). Each year I travel to three or four locations to get hands-on with the history. As well as some incredible engineering (Sacsayhuaman, Giza and Saqqara spring to mind), many of these sites were built with a deep understanding of axial procession, a phenomenon that takes decades, if not centuries to observe (Earth moves through a cycle of ~26,000 years)2.

Although we don’t have much direct evidence, the probability is that the people who built monuments like the ones I mentioned were all very young. Young people get shit done. This was true then and is true now. I have written quite frequently about my interest in businesses focused on Gen Alpha and Z as they are in every sense, and completely obviously, the future.

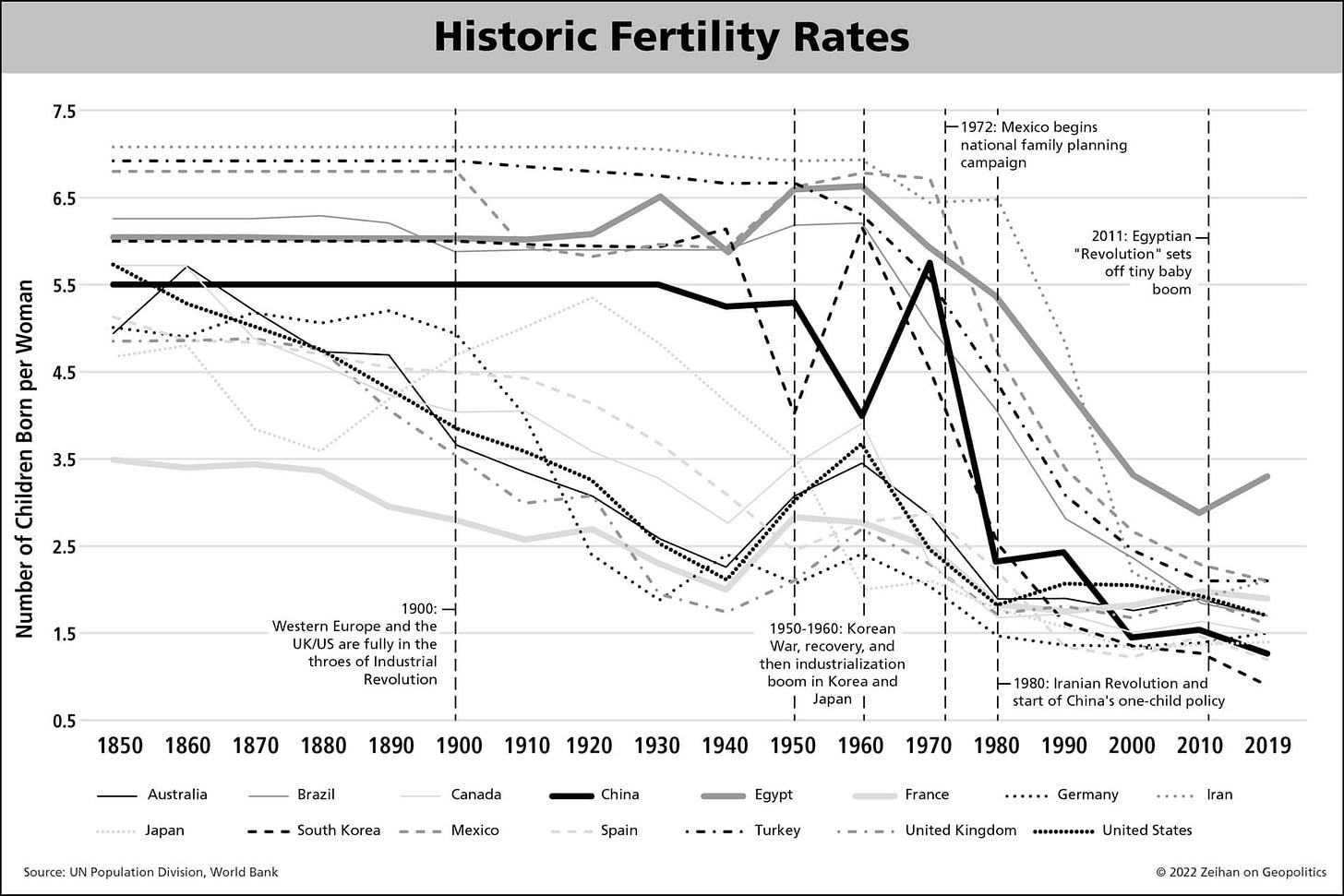

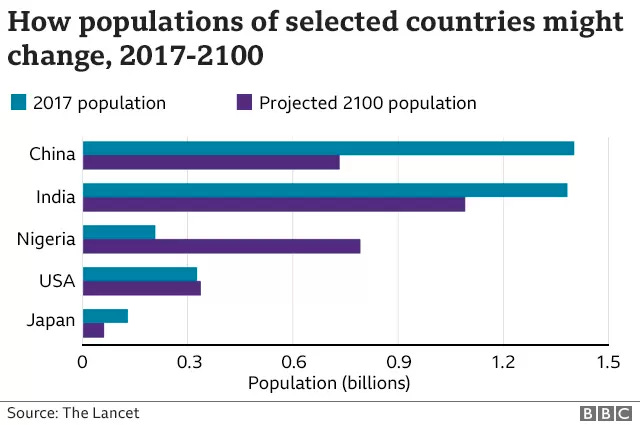

However, perhaps slightly less obviously, today’s generation of young people are increasingly a smaller future than we need. Although the generally understood narrative about young people is that of a globally shifting density from the west to places like Nigeria, Pakistan and Indonesia, this misrepresents what’s happening at an aggregate level when you look at fertility rates.

In short, it’s not that young people are becoming a scarce commodity in the west but on a global level the absolute number of young people is decreasing.

And, to really state the obvious, this also means that the ratio of young people to old people is going to continue to shift in favour of the latter. In short more and more of the global economy is going to, demographically, look like Japan3.

This probably doesn’t matter in the 2020s. But it might start to matter in the 2030s. Many people reading those sentences will shrug but for anyone running, say, a ten year VC fund with a two year extension, they might well raise an eyebrow (investing is, generally speaking, about the future).

Over the weekend I got into some light X/Twitter debate about whether AI can help with this challenge. The general e/acc view appears to be that AI will make it easier to have more children. I’m not a parent (or a doctor for that matter) so can’t assess that but I do wonder whether we are really in a race to ensure that we have enough of a functioning economy to benefit from any kind of AGI (or a climate-balanced planet for that matter).

Things you might want to consider over a ten (or even twenty year4) horizon looking at this data:

Countries are going to get real serious about baby-making. I once joked about the west adopting the inverse of China’s one-child policy but the more I think about that the more it seems like a real possibility

I continue to think about the challenges of investing for Gen Z. It feels like some kind of Jack Bogle style breakthrough is needed. What is the index investing solution for when everything is overpriced?

Increasing protections for the general well-being of young people, not necessarily empathy-driven (although maybe) but at least to ensure a robust tax-generating base for everyone else. Perhaps this comes in the form of some kind of income tax ring-fencing allocating minimum resources towards young people.

Ageism becomes the new racism. Immigration policies start to focus on attracting young people and young families

The importance of new generations sustaining capitalism is a weird sentence to write. But it feels like the the economic activities of young people can only get more important in the scenario where there are less of them (and where retirement pensions rely on companies making money from them).

On matters of the future, I find optimists (often VCs) frequently attack the pessimists for wanting to sound smart while being intellectually lazy. The pessimists (often not VCs) attack the optimists for not reading enough history. Demographics are pretty deterministic though. I feel we’re going to see (and need) much more discussion about this topic over the next ten years.

Other things I’m learning about

A useful read on M&A strategies.

A rotating detonation engine as the future of supersonic travel

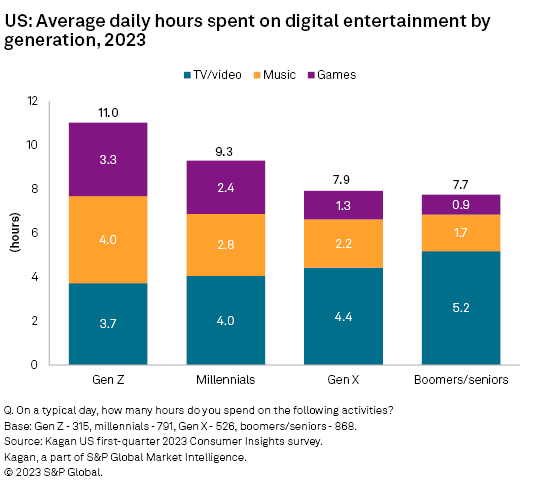

How my non-entertainment content spending is evolving. Is this similar for everyone else too?

Empathy Trends in American Youth Between 1979 and 2018: An Update. Psychologist Jean Twenge has the summary

SeedLegals launched Termometer, the terribly named but still useful guide to UK investment deal terms

Reading: The Snowball by Alice Schroeder (second reading). Also I’ve just finished Max Chafkin’s solid biography on Peter Thiel. I think it’s interesting how much both Buffett and Thiel obsess about downside protection (one of the more surprising things from Thiel’s biography is how conservative an investor he actually is). I think one of the downsides of simplified homely stories is that it dramatically underplays the amount of actual research which goes into deals. New investors barely scratch the surface with diligence (or investigate completely the wrong things). It’s still amazing to me how many investors don’t ask to see bank statements.

It’s not actually predictive but Kyle Harrison’s 2023 look-back has been the most enjoyable post I’ve read in this broad category.

One day I’ll go full Graham Hancock and write an entire post on this topic

An interesting exception is that because the US baby boomer generation were so prolific in also having babies, the US is one of the very few countries (France and Sweden are others) which is maintaining a reasonable ratio of younger people for longer.

When you spend enough time studying the works of people who thought in millenia, it makes year-long predictions seem a bit shallow.