The probability of being acquired (and who might buy you)

The evolving landscape of investors and buyers and how some founders are reacting

There is some version of the world I could absolutely live in where my only source of commentary is provided by Jason Lemkin and Matt Levine. Maastr. Or possibly something less terrible than that.

Anyway, Jason had an interesting reality check post for founders (and investors) referencing some new data released by Theory Ventures on the number of exits for VC-backed companies:

In contrast, if you look at a wider universe of comparable companies (TMT and consumer), you’ll see that overall M&A is, on average, increasing slightly over the same period of time (presumably if you remove the VC-backed companies from that data-set, then the rate of acquisition growth over time is somewhat higher again).

Out of curiosity, I took a look at new company formations in the US to see if there was any correlating trend but actually (netting out for Covid ramifications) it’s remarkably flat at about 100k new companies started each month (based on the High-Propensity new starts, defined as those that have a higher likelihood of becoming businesses with employees and payroll capabilities).

Also if you’re curious about this kind of thing, roughly 100k US companies declare bankruptcy each year.

For both founders and investors in companies below a valuation of $250m, the woolly interpretation of these data are:

You are, statistically, more likely to be acquired without VC backing, than with

If you do raise VC but if you can’t build in the top decile of both category (growth, importance) and ranking (position within that category) then you should not expect to get paid as well for being competent i.e. your exit pricing is unlikely to be extraordinary

The individual stock-picking of VC is, again in aggregate, seemingly less efficient than the general market as a whole, measured as a function of exits

If you are good or lucky enough to be building or investing in one of these top decile companies/funds then you should fight very, very hard to get as much of it as you can and probably assume you are under-pricing at each round (puts the Benchmark/Uber story in some context)

FOMO will continue to be an optimal fund-raising strategy for VC (the corollary of this is you should expect increasingly more extreme ghosting from VCs if your performance dips)

None of this is new information though. M&A is simply not all that common. However, I think it’s also worth considering this data in the context of who the buyer is. Although this has certainly been true for many years now, it’s becoming much more understood that the more likely buyer of your company (should the scenario present itself) will be private equity rather than strategic.

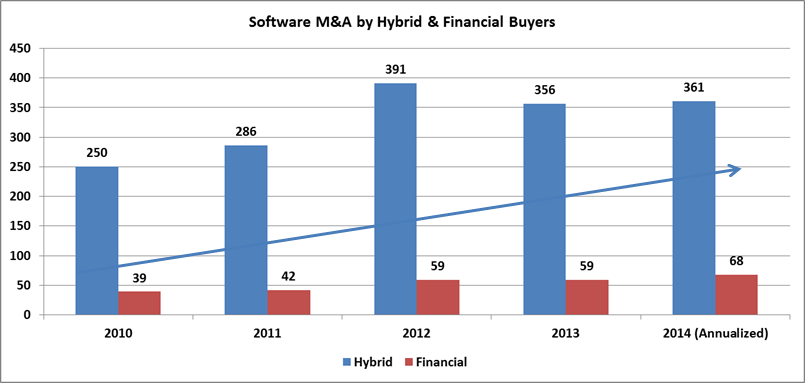

Historically this was not the case. Here is some data from a decade ago (source):

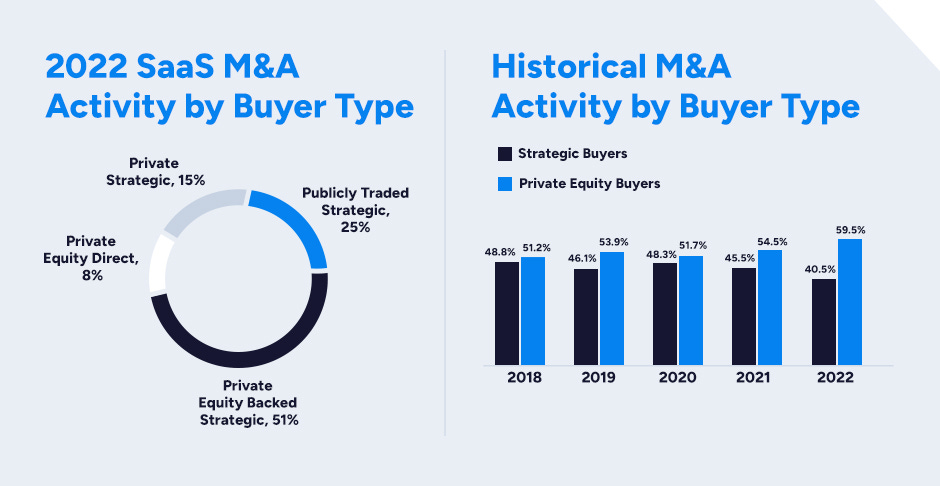

And here is some different data (source) which gives you a sense of the continued rise of PE as a buyer group in this category:

This trend has now reached the stage where, at least in some technology categories, PE is probably the more common acquirer of companies (source):

So revisiting my previous statement: M&A is simply not all that common but when it happens, it will probably be a PE fund (it was nice to hear Mark Suster talking about this recently too).

There is a whole post that can be written about the pricing implications of this (spoiler: pricing will decrease). This is not that (although I feel this was maybe part one) but suffice it to say that you should assume your valuation is going to be a function of EBITDA and growth rate and nothing else.

A zoonosis is an infectious disease that has jumped from animal to humans (if you want to read more about this, I recommend David Quammen’s excellent Spillover). In a pre-newsletter post, I wrote about my expectation that the PE behavior of buying companies would eventually find a way of jumping to VC. This has not yet happened. However you are certainly seeing more founders starting to think this way in a couple:

Founders are skipping from management to capital. You can see this with what Travis Kalanick is doing with CloudKitchens. You can see it in a slightly more fund-structured way like Balio. And you can see it through the medium of venture studios like Jay Radia’s Blissgrowth. Historically most of these vehicles would have been launched by people with a purely investing background.

There is a lot of talk by repeat founders about holding companies and roll-up vehicles. Some of this is idealistic thinking about building without operating but certainly some of it will be successful.

The other emerging behavior is the one-and-done model which I hear a lot of founders talk about i.e. we’re only ever raising one investment round. This might be reflective of real VC-deleveraging or it might be an excellent FOMO tactic, only time will tell.

I find these developments pretty exciting.

“Since I came in the industry, a lot of shit’s changed/I paved the path, I made the way/And I can switch lanes” Meekz (Mini Me’s)